As UK car sales figures for the vital first quarter of 2018 are released today, highlighting a continued and dramatic decline in diesel purchases, global automotive analysts Sophus3 reveal that potential electric car buyers seeking alternatives are increasingly confused and frustrated over their online experience: are the car manufacturers missing a trick, missing sales and slowing down electric vehicle uptake as a result?

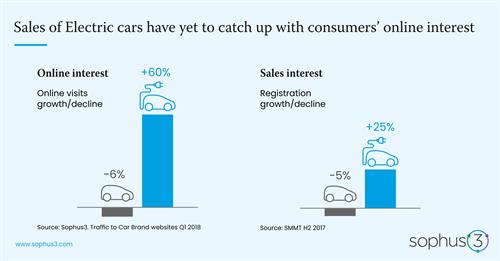

Sophus3’s analysis clearly shows that interest in electric vehicles is increasing significantly on car brand websites – up 60% year-on-year in 2017* – but that most consumers are not ultimately choosing to buy electric – below 2% of the UK new car market* – for a number of possible reasons:

-Â Electric vehicle considerers are frustrated with their online experience – yet show a greater hunger for information and are more disposed to request a test-drive than petrol or diesel considerers

– Some car brands are still (incorrectly in Sophus3’s view) marketing electric as an ‘alternative’ or ‘lifestyle’ choice, when Sophus3’s analysis shows that electric vehicle considerers are now at a point of comparing petrol, diesel, hybrid or electric on a level playing field, focusing on running costs, monthly payments and ownership practicalities

– Yet some manufacturers are also presenting electric vehicles in typical, and virtually irrelevant, “petrolhead†terminology such as horsepower, top speed and 0 – 60 mph time

– Most cars are now ‘purchased’ through monthly finance payments and the base level of payments favours petrol and diesel over electric

*Figures taken from the Sophus3 report “The end of the ICE age? Digital insights into the electric vehicle buyerâ€Â https://www.sophus3.com/2018/01/11/the-end-of-the-ice-age/

Scott Gairns, Sophus3 Managing Director, said: “As Governments and local authorities continue the process of forcing diesel cars off the roads and high-profile pure electric brands such as Tesla make headlines, our analysis shows that the consumer is taking note, is interested in electric, but is still massively confused.

“But in today’s digital world it is vital that car-buyers are provided with all the knowledge they need, in the form that they consume it, and at the time they want it from those responsible for charging networks, selling cars and developing technologies. If not, there is a looming gap between “interest†and “purchase†that will leave older diesel and petrol cars on the roads, undermining the UK’s drive to be a leading electric vehicle market.â€

Sophus3 is independent and tracks automotive web traffic across 42 markets, analysing the behaviour of 28 million visitors per month through a record 1.27 billion website visits in 2017. It is the only automotive analysis business in Europe that has a full and un-biased picture of all major European car market consumer behaviour and online journeys, on and between automotive websites: arguably a truer picture of car-buyer behaviour and desire than new car sales results.

Sophus3’s analysis and intelligence particularly focuses on consumer demand right now, what car-buyers are likely to buy in the next 60 days, and data that indicate future car-buying trends. With over 15 years of online car-buyer behaviour knowledge, they can present future car-buying behaviours with a high degree of confidence.